how are annuities taxed to beneficiaries

If you have at least 10000 of earnings in your annuity the entire 10000 is treated as income and would typically be taxed as ordinary income. Only if the annuity is a non-qualified one will you have to pay taxes on the income it generates.

Annuity Change Of Beneficiary Form American General Life

Non-qualified annuities are taxed based on what is called the exclusion ratio.

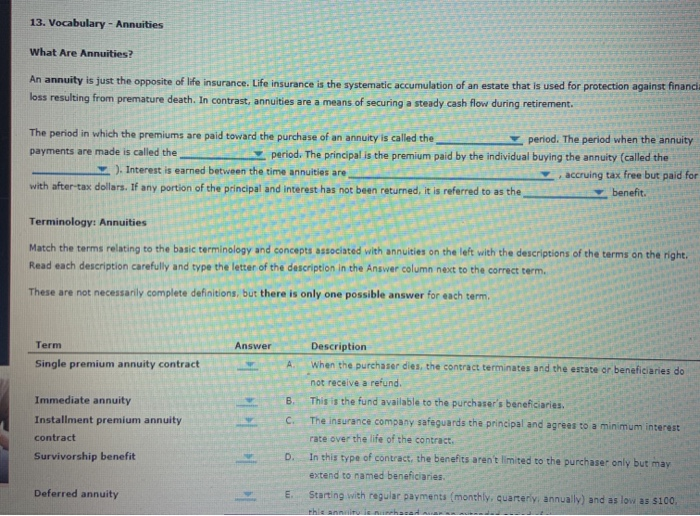

. The estimated number of payments from your annuity are divided equally by the. How are annuities distributions taxed. The government only taxes annuities when you take distributions.

If you simply take over the payments you will. In addition non-qualified annuities use post-tax dollars that are taxed for gains when theyre withdrawn. The taxed amount depends on the payout structure and the beneficiarys.

The only time you will be taxed on annuity funds you inherit is if they are distributed directly to you. This means the money was already taxed before it was put into the annuity. Because the annuity purchaser invested after-tax dollars the principal isnt taxed when distributed.

How are annuities taxed to beneficiaries. Qualified annuities require those who. For example a standard lifetime annuity on.

Tax rates depend on the amount of income you earn and the tax bracket in which you fall. The IRS taxes your entire distribution from qualified annuities. Heres why the distinction matters.

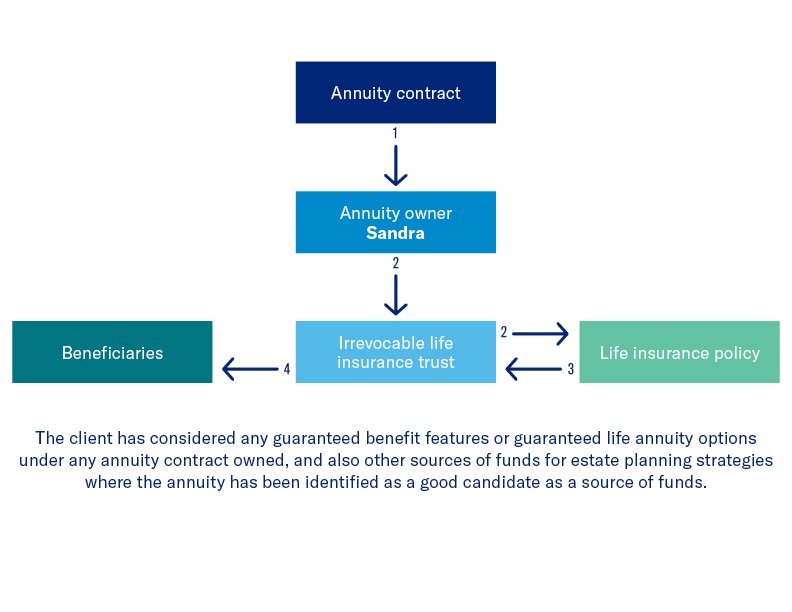

Under certain circumstances the annuity can be distributed and. Beneficiaries of a trust typically pay taxes on the distributions they receive from the trusts income rather than the trust itself paying the tax. Annuities are tax deferred.

What this means is taxes are not due until you receive income payments from your annuity. When you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income. Annuity Payments vs.

Your annuity income is taxed as regular income when you do pay taxes. The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. How are non qualified annuities taxed to beneficiaries.

After you exhaust the earnings in. Any money you take out before age 59½ will also be. Children who are beneficiaries are required to claim only the untaxed portion of the annuity on their tax return.

The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. On the other hand. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account.

Are annuities taxable to beneficiaries. Withdrawals and lump sum. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of the employees.

However annuity distributions suffer heavy tax penalties if touched before. Yes possibly however this really depends upon the type of annuity that has been put in place. The taxed amount depends on the payout structure and the beneficiarys.

When you take out an annuity you will have the option to add death benefits that could mean your income or remaining pension funds will. Qualified annuities are funded with pre-tax dollars. Non-qualified annuities are funded with after-tax dollars.

Fact checked by. Income taxes on the. How Are Annuity Gains Taxed.

However if the amount is taken as an annuity then the annuity is taxable in the hands of the beneficiary at the beneficiarys rate of tax as and when the annuity is paid. In addition to determining taxable annuity income exclusion ratios determine how much of it is. In most cases non-qualified annuities can remain tax deferred all the way until the death of the owner.

Annuity Taxation How Various Annuities Are Taxed

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Beneficiaries Inheriting An Annuity At Death 2022

How To Avoid Paying Taxes On An Inherited Annuity

Annuity Taxation Fisher Investments

Annuity Beneficiary Claim Form Fill Out Sign Online Dochub

The Annuity Advantage By Blue Horizon Insurance Financial Services Ppt Download

Trust Vs Restricted Payout As Annuity Beneficiary

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Increasing Wealth Transfer Using Deferred Annuity Distributions

Inherited Annuity Tax Guide For Beneficiaries

Substantial Gains In Your Non Qualified Annuities You Ve Got Options

Form Of Application Fpr Allstate Retirementaccess Variable Annuity Contract

Annuities From Protective Life Guaranteed Retirement Income

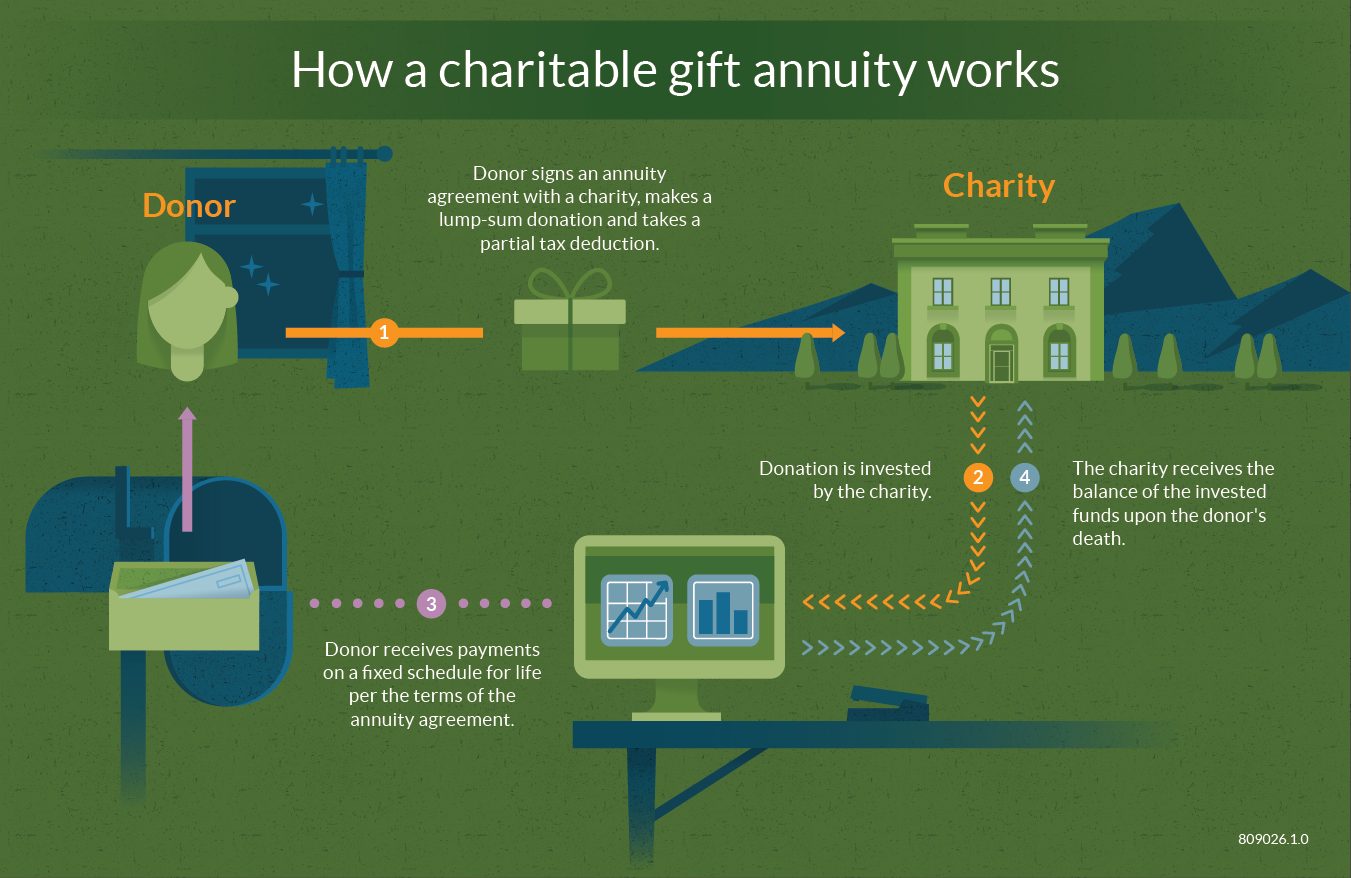

What Is A Charitable Gift Annuity Fidelity Charitable

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Solved Possible Options 1 Chegg Com